Why Internet Based Business Owners are Choosing Peartree for their Financing

A home based of internet e-commerce business can be very challenging for the business owner to secure financing. Lenders don’t feel the business has any “tangible” fixed premises from which it operates. This can be very frustrating given you, as the home based internet entrepreneur puts in as much time and hard work as the traditional “brick and mortar” business owner. So, one frustration you could do without is having to wait on banks when you need working capital. Whether you’ve applied for a small business loan and been turned down, or you can’t afford to wait the weeks and weeks a bank loan would take to get you the capital you need. A merchant cash advance or small business loan through Peartree Financial offers a better way:

Lowest Rate Guaranteed

With the vast source of lending companies at our fingertips, we can guarantee you that you will get the LOWEST RATES AVAILABLE…GUARANTEED!

Fast and Simple

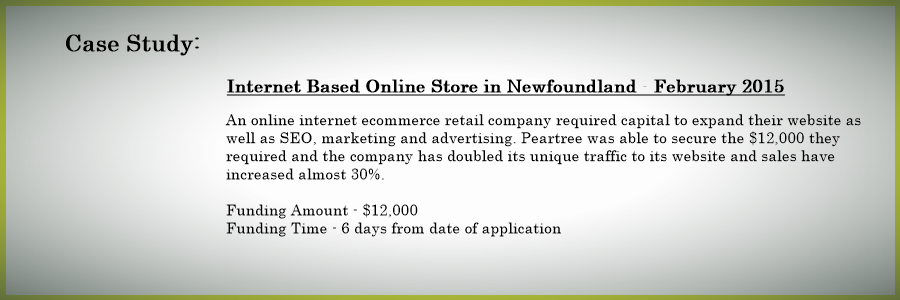

Most of our home based internet etrepreneurs receive a pre-qualification for a business loan, merchant cash advance or line of credit from us within 24 hours of submitting the 1-page application and supporting documents, and actually receive the money in their business bank account within 5-7 business days. The process for obtaining a traditional small business loan from a bank could take several months.

Minimum Documentation and No Collateral Required

Unlike traditional banks, we don’t require the same amount of documentation, nor is collateral required in order to provide you with financing. All that is required to obtain a pre-approval is our 1 page application, a few months of bank statements and merchant processing statements.

Personal Credit Is not a Problem

Many factors are taken into consideration when funding companies underwrite a merchant’s application and we have secured funding for merchants who have credit scores under 500. Business loans often require a minimum FICO or credit score.

Flexible Payment Schedules

A business cash advance isn’t a traditional loan. The advance is paid back as a percentage of your credit card sales. When business picks up, you pay back more and when business slows, you pay back less. With a business loan, the payments are a pre-set amount which may actually be beneficial in the daily planning of your future cash flow projections.

Find out How Much Your Internet Based Business Would Qualify For

Simply Request a Consultation by filling out the form to the right and one of our Business Financing Specialists will follow up with you within 24 hours.